It looks to me like an irregular flat correction is forming on the EUR/GBP pair. Price reversed very close to the 138.2% Fib level which is very common in FX markets during flat formations. Expect price head towards at least 0.88 if not slightly further before further downside.

Friday, January 29, 2010

Thursday, January 28, 2010

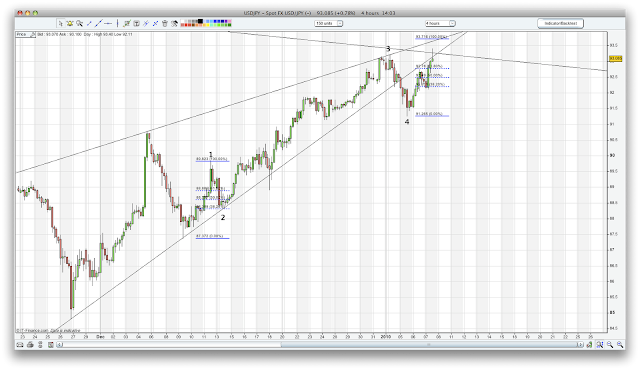

USD/JPY Ending Diagonal Complete

My previous ED count for the USD/JPY pair was incorrect, and price was held near the 61.8% Fibonacci of the A wave. Since completion of the diagonal, price has broken through resistance and then retraced to re-test the new support line. Expect a complete retracement to the starting point of the diagonal to around at least 90.50 over the next session and continues USD strength against the Yen.

Wednesday, January 27, 2010

USD/JPY Ending Diagonal Count

Here is my current favoured count for the USD/JPY pair. It looks as though an ending diagonal is forming, as both waves 1 and 3 look to be in 3 waves. Expect a throw over which is usual for EDs. I will be looking to buy at around 88.70 if price action does not invalidate this count before it reaches the entry point.

Monday, January 25, 2010

EUR/GBP Trade Idea

Just a quick rehash on my EUR/GBP trade from a while back. The pair looks like it wants to retest the old wedge support line at around 0.8870. Fibonacci resistance also sits very close to this zone. Look to short from here with a stop above the high at 0.9030. I will be away celebrating for most if not all of tomorrow's sessions. Happy Australia Day!

Sunday, January 24, 2010

USD/JPY Possibilities (2 Hour Chart)

As you would already know if you are a regular reader of my Blog, I am medium term bullish on the USD/JPY pair. In the above chart I have drawn the most bullish scenario, with the red X zigzag already complete and about to make a sharp move upwards. So far price has held near the 61.8% Fib of wave A. The move from 89.79 on the 5 minute chart counts as a clear 5 waves, and the retracement so far looks to be in 3 waves, however it is extremely deep, so confidence in this count is not high. It should become apparent very early in the Monday session if this count is valid or not. A break of 89.79 will invalidate.

In the chart below I have labeled the red X as a double zigzag. This means wave C of the second zigzag is still to come. A probably target for wave C is 88.50, which is very close to both the 100% extension of wave A of the second zigzag and the 100% extension of the first zigzag of the red X. If the above count is invalidated, 88.50 is where I will be looking to take more long positions in this pair. I will be away most of tomorrow and Tuesday, off celebrating Australia Day, so I probably won't be able to update the site through the day, but if price drops through 89.80, set buy orders to 88.50, with stops at 87.00.

Friday, January 22, 2010

USD/CHF Hourly Chart

The USD/CHF and USDX both have a very similar count at present. 3 waves up are clear with a 4th wave currently in progress. As wave 2 only retraced 38.2% of wave 1, it is likely wave 4 will retrace around 61.8% of wave 3. This leaves a very good opportunity for a trade with an enviable risk to reward ratio. Look to buy at 1.034 with a stop at 1.029. Target is above 1.05. Move stops to break even when feasible.

AUD/USD Hourly Update

Here is an update of my AUD/USD chart from earlier in the week. As you can see support at 0.918 has been broken and further downside is expected in a wave 5 to around the 50% Fib at 0.90. A breach of 0.9175 will take wave 4 into the territory of wave 1 and invalidate this count. A low risk scalp would be to set a short at 0.915 with a stop 30 pips away at 0.918. Target 0.903 and move stops to break even to negate and possible loss when feasible.

Thursday, January 21, 2010

USD/JPY Chart Update

The USD/JPY looks to have been rejected just beyond the 38.2% Fibonacci of the last move downwards, and the black X may be complete. A double zig-zag formation is likely (being the most common form of correction), with an ABC down to the red X still to come. I have taken a short trade from where I removed my long positions at 91.80. I have been following USD/JPY closely combining my wave counts with Delta counts and have a high confidence in this setup. I expect weakness in the USD against the Yen over the coming week or so, before a sharp move upwards in the pair.

Wednesday, January 20, 2010

USD/JPY Hourly Chart

I think USD/JPY is in the process of finishing off a c leg of a B of an X. Expect resistance at around the 0.92 area, before a reversal and a C (of X) leg down to around the 0.89 area.

AUD/USD Hourly Chart

Here is what I think is happening in the AUD/USD. As you can see there is a clear 5 waves up. I am expecting a break of the support line within the next session, with a fair amount of follow through the bring the pair down to around the 0.90 area. It is possible that a wave ii flat is forming, which means it will take longer before the support line gives way. A move above 0.933 invalidates this count.

Tuesday, January 19, 2010

Spot Gold Hourly Chart

Here is an hourly count for Spot Gold. The wave count seems very clear on this one. I think we are currently in a wave C down, and expect a fall to somewhere between the wave 2 extreme (1086) and the 61.8% Fib (1108). Wave A will equal wave C at 1104. Cautious traders may want to wait for a break of the rising trend like support before shorting. Keep stops at 1147.

Saturday, January 16, 2010

EUR/USD Bullish Possibility Update

Sorry everyone if I've been confusing you with all my competing counts. I'm merely giving you some of the possibilities it's up to you to decide which one you think is correct. Thanks to Dave for reminding me about my chart from the last week which gives this count. As you can see the EUR/USD may be completing a B wave down with a C leg still to come. 5 waves down for C of B looks complete or almost complete. If you're bullish on the pair keep your stops at 1.4265.

Friday, January 15, 2010

EUR/GBP Break Out!

EUR/GBP has just broken out from the wedge it has been consolidating in for the past several months, and also broken through its uptrend channel support which has been in play for several years. Wait for a pullback to resistance at around 0.888 and look to go short with a stop at 0.904. This is likely going to be a medium term hold.

EUR/USD Bearish 5 Minute Chart

Here is an update of my bearish EUR/USD count. Support at 1.441 is where the drop from 1.452 is approximately equal (by price) to the previous 2 drops down shown in the chart from 1.458 and 1.4556. This may not be significant, however Elliott Waves are often Fibonacci ratios of each other, 1:1 being one of them. This is my favoured count at present and I expect further downside. I have moved my stops to 1.4447 (the bottom of wave i) as it is important to protect profits in these choppy conditions, and a break back above 1.4447 negates this count.

*** EDIT *** Sorry a break about 1.4492 negates this count, not 1.4447. Although I was stopped out of my short trade with +93 pips, my bias is still to the downside and I will look to get short again on a pullback or a break back below 1.4410.

EUR/USD 15 Minute Chart Bullish View

Here is a bullish 15 minute count for the EUR/USD pair. There may be another impulse wave up coming to complete the 5 waves up from 1.4265. A break back below 1.4473 negates this count and puts the focus back on a bearish count.

*** EDIT *** This count has just been invalidated. Stay short on this pair.

Thursday, January 14, 2010

EUR/GBP Wedge Breakout Imminent

The EUR/GBP price action is contained by clearly defined, converging support and resistance lines. Keep an eye out for a break in either direction, then look to buy on a pullback to the resistance line. Keep your stop loss on the other side of the wedge and move to break-even once price has moved sufficiently away for your order price. I have no current directional bias on this pair and am equally as happy for it to break to either side.

AUD/USD 15 Minute Chart

Here is my interpretation of the corrective price action we have been seeing lately in the AUD/USD pair. I think a flat is almost complete and we will be seeing some USD strength over the coming session. As you can see wave 5 of c of B is almost reaching the point where it will be equal to wave 1 of c of B.

EUR/USD 5 Minute Chart

Just a quick snapshot of the count I believe the EUR/USD is following. I just got short at 1.454 with my stop loss at 1.458.

Wednesday, January 13, 2010

USD/JPY 4 Hour Chart

My previous count was almost invalidated this morning when my assumed wave 4 price dropped to a low of 90.724 just within the territory of wave 1. Although there is the 15% crossover rule for leveraged markets, I find it extremely rare that this occurs. I have for the last week been struggling to find a common ground between my own EW analysis, Asher's Ichimoku Analysis and Cmellon's Delta Counts for this pair. The conflict between the various counts means someone had to be incorrect.

Cmellon's Delta Count, has a MTD 8 arriving 15-20 days after MTD 7 which is now confirmed as being on the 7th of Jan. This fits in well with an X being in progress at the moment. Wave A and wave C are almost exactly equal, which is quite common, and gives power the the likelihood of this count. So the down move which I expect will be an X, should end between the 22nd and 27th of Jan. Before a larger up move, another ABC. Keep in mind X can be any consolidation pattern, not just a zig-zag. It may form as a triangle or even a flat.

USD/JPY A New Count

Here is a 4 hour chart of the USD/JPY. The recent move down could be a wave 4 complete, or the pair may consolidate in a triangle before further upside. It is also quite possible that what I have marked as iii, should be marked as 3, and a wave 4 flat is complete or near completion. I have marked in blue the entire price movement of wave 1. As you can see wave 3 is only slightly larger than wave 1. This builds a strong case for an extended wave 5. Look to get long with a stop below the wave 1 extreme at 90.77.

Tuesday, January 12, 2010

EUR/USD Wave 4 Correction Hourly Chart

Here is an update of the correction the EUR/USD is currently involved in. I expect price to push slightly higher before a pullback where I will look for an opportunity to buy.

Monday, January 11, 2010

USD/JPY Ending Diagonal Count

Here is a possible count for the USD/JPY pair. Wave i of 5 is an obvious 3 wave move which is why an ED count came to mind. If the pair plays out as predicted, look to get short on the break of the ii/iv trend line.

AUD Looking strong. Could the US Dollar Bear still be in Control?

The AUD/USD has rallied sharply over the last fortnight in what looks to be an impulse wave. 5 waves up looks almost complete and coincides with the pair moving into an area or previous resistance. 0.9320 should not break too easily but if it does fold, 0.94 will be the next hurdle. I don't think it is very likely that this impulse wave will extend even though wave 3 < 1.618 x wave 1. Wave 5 = wave 3 at 0.9380. Look for a turn around there if 0.9320 gives way. I am not trading this pair at the moment but may consider getting long after a wave 2 pullback.

Friday, January 8, 2010

USD/JPY 15 Minute Chart

Here is a 15 minute chart showing the recent price action on the USD/JPY pair. My bias has changed and I now think the pair is likely to head higher due to the delta time limitations that I mentioned in my post a few days ago. Here is an update. Although it is possible that a flat forms, I now think price will likely fall just below 93 in a wave 4 and then head higher. Move your stops to the bottom of wave i down at 93.35 once price has fallen 25 or so pips below it to cover yourself.

USD/JPY Makes a New High

Above is a 4 Hour Chart of the USD/JPY pair. 4 waves up can clearly be seen, however wave 4 may or may not yet be complete. If wave 4 is complete, wave 5 will be equal to wave 1 at around 93.70. Below is the same chart but with wave 4 drawn in as an irregular flat. This is what I believe to be the more likely scenario at present due to the look of the recent price action on the hourly (see bottom chart) which looks likely to complete as a 3 wave move. Wave a of B will be equal to wave c of B at 93.60. Whichever scenario plays out, I believe selling this pair at around that region should be profitable. Keeps stops above 94 and move them to break even when price has fallen back to 93.

Thursday, January 7, 2010

AUD/USD H&S Failure

Price has reverted further above the neckline of the head and shoulders pattern making a drop to 0.85 in the coming days unlikely. Above is a bearish chart with a possible 1-2-1-2 count, however with every passing day I increasingly question whether my call for a USD bottom may be premature. The strength of the rally against the US dollar over the past few days means it is probable that there will be one more high to come for the AUD against the Greenback. For the above chart to remain possible price must not exceed 93.23. Below is a bullish AUD/USD chart which is beginning to seem like the more probable outcome. Although the rally may extend further north, a pullback to the 61.8% Fib will be likely sometime soon, as a wave 2 of 5, so be cautious if placing longs at current levels.

Wednesday, January 6, 2010

USD/JPY 30 Minute Chart

Here is a 30 minute chart of what I believe is happening in the USD/JPY pair. As you can see there are a clear 5 waves down, and price has so far corrected to near the 50% Fibonacci level. I expect further downside to occur in a C wave soon and will be looking to short again at 92.45.

Tuesday, January 5, 2010

USD/JPY Trend Line Break

The USD/JPY pair has broken through support and looks like it may correct over the coming week. Cmellon's Delta count is also short term bearish on the pair: click here. I will be looking to short over the coming session on a small pullback to support with a stop above the recent high at 93.25.

NZD/USD Reaching Resistance Zone

The New Zealand dollar is currently just beneath a resistance line drawn from the top of the two most recent highs, and a zone (0.73-0.7370) which has acted as support/resistance a multitude of times over the last few months. This area of confluence will be considerably difficult for the currency pair to push through and I expect price to reverse from these levels.

Monday, January 4, 2010

EUR/USD 4 Hour Elliott Channel Chart

Here is a chart of the EUR/USD pair, with wave 5 labeled to have topped out at 1.5145, as opposed the the Ending Diagonal Count where wave 5 ended at 1.5142. This count seems to fit better with the way price has acted over the past month and as you can see from the above chart a clear Elliott Channel is forming. If this count is correct and price action remains bound by the channel then we should expect weakness in the Euro very soon, as price is almost touching channel resistance.

AUD/USD 4 Hour Chart

The AUD/USD pair has rallied above the 0.9015 level, thus invalidating the chart possibility I posted on December 28th. Here is the alternate count I proposed, where the currency pair may be forming an extremely bearish 1-2-1-2 formation. I have drawn in the Fibonacci levels above in blue. As you can see price action has almost reached the 61.8% level, which is right on 0.91. I expect some resistance at this level. The head and shoulders pattern we have been watching develop over the previous months is still valid, however with every push higher the likelihood of the pattern playing out as we have been hoping diminishes.

Subscribe to:

Posts (Atom)